Terraform Labs’ recent bankruptcy announcement triggered many reactions in the crypto industry. A major one is the market starting the week in red with major assets like Solana’s SOL and Cardano’s ADA leading the losses.

Terraform Labs, the company behind TerraUSD and Luna Stablecoins has filed for Chapter 11 bankruptcy protection in the US. Terraform and its co-founder, Do Kwon, were held liable for the collapse of two cryptocurrencies that wiped out $40B from the crypto market in 2022.

Terraform Lab Pte, filed a voluntary petition in Delaware on Sunday, January 21. It declared in the filing it has between $100 to $500 million in estimated assets and the same amount in liability.

The two stablecoin projects owned by the Singapore-based company, TerraUSD, a dollar-pegged stablecoin and Luna token collapsed in May 2022, causing investors to lose millions of dollars.

About Terraform Labs And Blockchain

Terra is a blockchain protocol that aims to provide a stablecoin ecosystem focusing on scalability, usability, and interoperability. Terra’s native stablecoin, TerraSDR (formerly Terra), is designed to maintain a stable value pegged to the Special Drawing Right (SDR) and is used for various decentralized applications (dApps) and DeFi platforms.

Terraform Labs is the team behind the development of the Terra blockchain. The team comprises blockchain and cryptocurrency experts working on building and expanding the Terra ecosystem.

Terra’s stablecoin is designed to be stable and maintain its value by pegging it to a basket of fiat currencies.

The Lawsuit

Terraform cryptocurrencies suffered a loss of $40B when TerraUSD broke its $1 peg in May 2022. Kwon, the majority shareholder, is wanted by South Korea and the US following the collapse of TerraUSD and the Luna token.

Presently, Kwon is in Montenegro for using a fake international passport and may be available to the US around mid-March, based on a statement by Kwon’s lawyer, to face security fraud charges in a Manhattan district court.

According to the filing, TFL is expected to execute its business plan while handling the ongoing legal proceedings, including its representative’s pending litigation in Singapore and the US.

In a statement, the lab mentioned a list of companies as unsecured creditors, TQ Ventures, a U.S.-based digital assets investment fund, and Standard Crypto, a San Francisco-based venture fund. Presently Terraform and its founder are facing a lawsuit in Singapore as well as a trial in the US from the Security and Exchange Commission, SEC, for the collapse of TerraUSD.

Impact of Terraform Bankruptcy on the Cryptocurrency Market

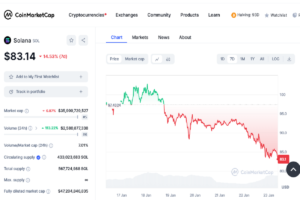

This bankruptcy announcement triggered a downward trend for the crypto market according to a coinmarketcap.com report. This showed in the market setting off in red on Monday this week. Some leading cryptos like Solana, SOL, which hit the threshold of over $100 last week can be seen plummeting to $83 at the time of writing, with an over 10% downward trend in just 48 hours.

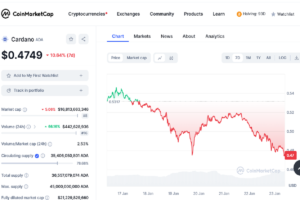

Another leading crypto asset in this downward trend is Cardano, ADA. The leading asset slid down to $0.47 from its $0.53 threshold last week. ADA saw over 6% loss in price this week from its last week’s gains.

The price change may not have as much impact on ADA as it does on SOL. However, the change was noticed from Sunday after the announcement of Terraform’s file for bankruptcy.