A United States district court recently imposed a sanction on the US Security and Exchange Commission, SEC, for the abuse of power and taking action against crypto companies based on faulty legal arguments.

Judge Robert Shelby ruled that SEC’s action against DebtBox which includes asset seizure and obtaining a temporary restricting order is a gross abuse of power entrusted to it by the congress.

DebtBox, a decentralized eco-friendly blockchain technology network based in Utah, was allegedly accused by the commission of being engaged in a cryptocurrency scheme that defrauded hundreds of investors of nearly $50 million.

According to Shelby, the evidence used by the SEC to obtain TRO against DebtBox is false and misleading.

In his March 18 ruling, the judge reprimanded the SEC for its misconduct and failure to correct mistakes even after they were made known to investigators. He wrote in an 80-page ruling that the court expects from the commission a higher standard of conduct and comportment with duties and obligations as any other litigant coming before the court.

Shelby ordered the SEC to compensate DebtBox for its attorney fee associated with the lawsuit and all expenses from the TRO and appointment of the receiver, including all costs and fees.

The agency obtained a false TRO that some individual mentioned in the suit moved $720,000 overseas to hide the asset and eventually flee the country.

Is the SEC For or Against Crypto Innovations in the US?

The US SEC has been hitting hard on crypto businesses more than other countries, making the public believe it’s not receptive to crypto.

In an interview with Bloomberg on March 3, Brad Garlinghouse, the CEO of blockchain-based digital payment network, Ripple, stated that the SEC’s regulatory approach puts the US at risk of losing out in becoming an attractive hub for the next evolution of blockchain and crypto innovation.

Garlinghouse noted that the SEC’s case against Ripple is an offense and a direct attack on the crypto industry. He frowns at the commission’s crypto regulatory process in the US which he thinks is behind other countries, like Australia, UK, Japan, Singapore, and Switzerland.

Other countries seem to be crypto-friendly, but unlike these countries with clear regulations, the SEC has unhealthy regulations regarding crypto processes.

Garlinhouse noted that the commission is gradually edging crypto out of the United States with its unhealthy regulations.

In an earlier interview, Kristin Smith, CEO of Blockchain Association told Bloomberg in a Feb. 22 interview that the crypt regulatory process in the US is happening ‘ behind closed doors.’ He called for more industry involvement in an ‘open process.’

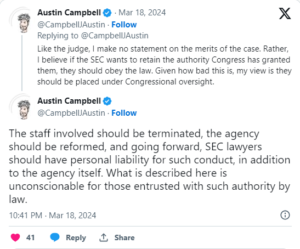

Austin Campbell, founder of the blockchain advisory firm, Zero Knowledge Consulting in a tweet called for SEC reform and termination of the staff involved.

Now the US lawmakers are geared to curb the SEC’s misconduct and fight against crypto through legal attacks and sanctions on major crypto businesses. This is hope rising for the US crypto space which may bring back industry innovations.