The United States Securities and Exchange Commission, SEC’s drawback on Ethereum ETF approval has not positively impacted Ethereum price.

According to coinmarketcap.com reports, the second-largest cryptocurrency by capitalization and the third by volume has been in the red position for more than a week. This drag in price can be attributed to the recent decision of the SEC, on the approval of BlackRock’s proposed spot Ether (ETH) exchange-traded fund (ETF).

On December 11, 2023, Nasdaq filed for the approval of iShares Ethereum Trust on behalf of BlackRock an American asset management company. BlackRock is an American multinational investment company and the world’s largest asset manager with about $9.2 trillion worth of assets.

Other applicants to the spot ETFs are VanEck, an American investment management firm, ARK 21Shares, Fidelity, Invesco, Galaxy, Grayscale, and Hashdex. VanEck application deadline is May 23, ARK 21Shares is May 24, Hashdex is May 30, Grayscale is June 18, and Invesco is July 15.

The delay announced one day before the January 25 deadline is the first the commission can exercise in a 240-day window.

Ethereum ETF Approval Slows Down Price Movement

Ethereum experienced a constant drop in price for the past week losing over 12 percent in price decline. The asset price dropped from $2,460 to $2,223 at the time of writing reducing market volume to $9.19 billion from $11.94 billion last week.

Ethereum investors have lost money in the past seven days to the tune of the current drop in the asset price. More investors may cash on this opportunity to buy more of the asset anticipating ETF approval.

The SEC earlier this month approved 11 Bitcoin spot ETFs to be listed on the United States Stock Exchange. The approval of 11 Bitcoin ETFs could guarantee the same instrument for Ether.

Experts’ Opinion on Ether ETF Approval Delay

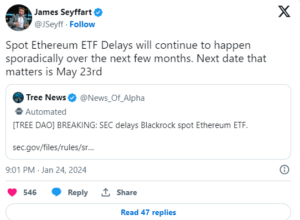

James Seyfartt, Bloomberg ETF analyst, in a tweet on January 24 stated he expects to see more spot Ether ETF delays over the next few months.

Morgan Creek CEO, Mark Yusko predicts a less than fifty percent chance of the SEC approving the spot Ether ETF

This drawback in SEC ETF approval points to the regulator’s stand on cryptocurrency as stated during the approval of Bitcoin ETFs.

An SEC commissioner, Hester “Crypto Mom” Pierce assured applicants that a court case may not be necessary since the regulator’s decision cannot be changed by the court.

“We shouldn’t need a court to tell us that our approach is ‘arbitrary and capricious’ for us to get it right.”

According to the SEC, more time is needed to review proposed rule changes. However, the commission must make a final decision on BlackRock’s spot Ether ETF application by August 7.

1 Comment

Your blog is always a highlight of my day